This formula as been changed to accept a string of OTM options till they hit a double zero bid, IE two O.00 bids in a row. The idea is to eliminate easy manipulation, if you are willing to place a 0.05 cent bid in to effect the pricing calculations, someone will see your order and realize its actual probability as unrealistic and hit your bid, IE pushing the chain back in line to the proper calculation.

below is a snip from investopedia, which is noteworthy, and work taking a moment to review.

A Lite Look for the Mildly Curious (l.S. investopedia quote)

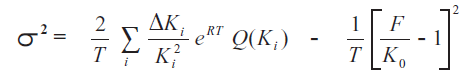

"The CBOE provides the following formula as a general example of how the VIX is calculated:

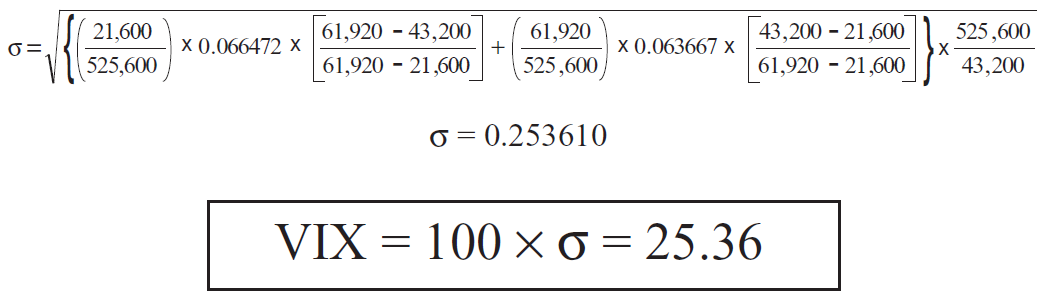

The calculations behind each part of the equation are rather complex for most people who don’t do math for a living. They are also far too complex to fully explain in a short article, so let’s put some numbers into the formula to make the math easier to follow:

Delving into the Details

The VIX is calculated using a "formula to derive expected volatility by averaging the weighted prices of out-of-the-money puts and calls”. Using options that expire in 16 and 44 days, respectively, in the example below, and starting on the far left of the formula, the symbol on the left of “=” represents the number that results from the calculation of the square root of the sum of all the numbers that sit to the right multiplied by 100. To get to that number:

- The first set of numbers to the right of “=” represents time. This figure is determined by using the time to expiration in minutes of the nearest term option divided by 525,600, which represents the number of minutes in a 365-day year. Assuming the VIX calculation time is 8:30am, the time to expiration in minutes for the 16-day option will be the number of minutes within 8:30am today and 8:30am on the settlement day. In other words, the time to expiration excludes midnight to 8:30am today and excludes 8:30 am to midnight on the settlement day (full 24 hours excluded). The number of days we’ll be working with will technically be 15 (16 days minus 24 hours), so it's 15 days x 24 hours x 60 minutes = 21,600. Use the same method to get the time to expiration in minutes for the 44-day option to get 43 days x 24 hours x 60 minutes = 61,920 (Step 4).

- The result is multiplied by the volatility of the option, represented in the example by 0.066472.

- The result is then multiplied by the result of the difference between the number of minutes to expiration of the next term option (61,920) minus the number of minutes in 30 days (43,200). This result is divided by the difference of the number of minutes to expiration of the next term option (61,920) minus the number of minutes to expiration of the near term option (21,600). Just in case you’re wondering where 30 days came from, the VIX uses a weighted average of options with a constant maturity of 30 days to expiration.

- The result is added to the sum of the time calculation for the second option, which is 61,920 divided by the number of minutes in a 365-day year (526,600). Just as in the first calculation, the result is multiplied by the volatility of the option, represented in the example by 0.063667.

- Next we repeat the process covered in step 3, multiplying the result of step 4 by the difference of the number of minutes in 30 days (43,200), minus the number of minutes to expiration of the near-term options (21,600). We divide this result by the difference of the number of minutes to expiration of the next-term option (61,920) minus the number of minutes to expiration of the near-term options (21,600).

- The sum of all previous calculations is then multiplied by the result of the number of minutes in a 365-day year (526,600) divided by the number of minutes in 30 days (43,200).

- The square root of that number multiplied by 100 equals the VIX.

Heavy on the Math

Clearly, order of operations is critical in the calculation and, for most of us, calculating the VIX isn’t the way we would choose to spend a Saturday afternoon. And if we did, the exercise would certainly take up most of the day. Fortunately, you will never have to calculate the VIX because the CBOE does it for you. Thanks to the magic of computers, you can go online, type in the ticker VIX and get the number delivered to your screen in an instant."

***************************